When your insurance plan suddenly stops covering your medication, it’s not just a paperwork issue-it’s a health crisis. For millions of Americans on chronic medications, a formulary change can mean jumping from a $30 monthly copay to $600 overnight. This isn’t rare. In 2024, formulary changes affected over 34% of Medicare beneficiaries and nearly half of commercially insured patients. The good news? You’re not powerless. Understanding how formularies work and what to do when they shift can save you money, time, and even your health.

What Is a Formulary, Really?

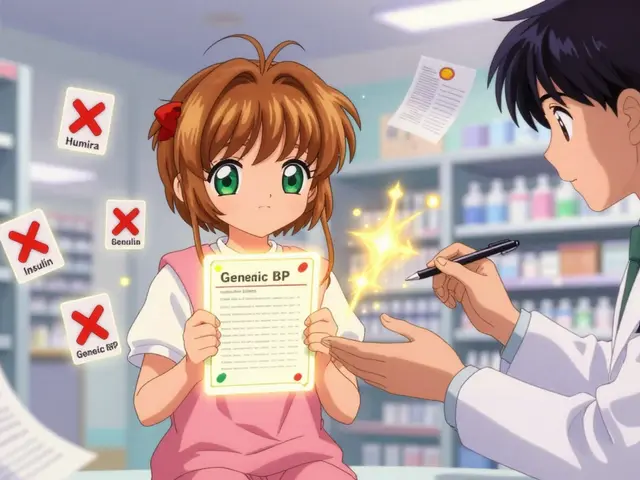

A formulary is a list of drugs your insurance plan will pay for. It’s not just a catalog-it’s a decision engine. Every drug on the list is placed into a tier, which determines how much you pay. Tier 1? Usually generics, maybe $5. Tier 3 or 4? Brand-name drugs, possibly $100 or more. Tier 5? Specialty drugs like Humira or Enbrel, where you might pay 33% of the full price. The goal? Cut costs for the insurer, but the result? Often, patients get stuck. Most plans use a tiered system. Over 90% of Medicare Part D plans and 87% of commercial plans do. Open formularies cover everything but cost more. Closed formularies block non-listed drugs to save money. And value-based formularies? They’re the new frontier-choosing drugs based on real-world outcomes, not just price. But here’s the catch: you rarely get advance warning.Why Formularies Change (And When You’ll Find Out)

Formularies don’t change randomly. Pharmacy and Therapeutics (P&T) committees review them quarterly. They look at new drugs, price drops, rebates from manufacturers, and clinical evidence. If a cheaper generic hits the market, your brand-name drug might get moved to a higher tier-or dropped entirely. If a drug’s safety record worsens, it gets pulled. You’ll usually get a notice in the mail or via email. But here’s the problem: 57% of patients say they got little to no warning. Commercial plans often give just 22 days’ notice. Medicare is required to give 30-60 days, but even that’s not enough if you’re on a long-term treatment. One Reddit user, ‘ChronicCareWarrior,’ shared how their Humira coverage vanished mid-year. Their monthly cost jumped from $50 to $650. They spent three weeks fighting for temporary coverage.What Happens When Your Drug Gets Dropped

If your medication is removed from the formulary, you have options-but they require action. First, check if there’s a therapeutic alternative. For example, if your blood pressure drug gets dropped, there are often 8+ generic equivalents. Ask your doctor: “Is there another drug in the same class that’s still covered?” Don’t assume they know your plan’s formulary. Many providers don’t check until the pharmacy calls them. Second, request a formulary exception. This is a formal appeal to your insurer to cover your drug anyway. In 2023, 64% of medically justified exceptions were approved. You’ll need a letter from your doctor explaining why the alternative won’t work. For instance: “Switching from Humira to adalimumab biosimilar caused severe rash and loss of disease control.” Third, use manufacturer assistance programs. Companies like AbbVie (Humira) and Amgen (Enbrel) offer copay cards or free drug programs for eligible patients. In 2024, these programs covered $6.2 billion in patient costs. You can find them through GoodRx or the drugmaker’s website. Fourth, if you’re on Medicare, contact your State Health Insurance Assistance Program (SHIP). These free, local counselors helped 37% more beneficiaries successfully appeal formulary changes in 2023.

How Providers Can Help (And What They Should Be Doing)

Doctors and clinics aren’t just prescribers-they’re your first line of defense. The best practices? Real-time formulary checks during e-prescribing. In 2024, 76% of large medical groups used systems that flag coverage issues before the prescription even leaves the office. If your provider doesn’t do this, ask them to. Or better yet, use your insurer’s online formulary lookup tool. Most have them. Medicare beneficiaries used Plan Finder 68% of the time in 2023 to check coverage before enrollment. Pro tip: Don’t wait until your refill is due. Check your formulary every October during Medicare’s Annual Enrollment Period. For commercial plans, check after any major life change-new job, divorce, moving states. Formularies shift constantly.When Formulary Changes Backfire

Formularies save money-for insurers. But they also cause harm. A 2023 Scripta Insights report found that 22% of patients stop taking their meds because of coverage changes. For diabetes drugs, that number hits 58%. When people skip insulin or blood pressure pills, they end up in the ER. One Health Affairs study found patients forced to switch drugs paid an extra $587 a year out of pocket. And it’s not just about cost. Dr. Aaron Kesselheim from Harvard found that excessive formulary restrictions led to 12% more emergency visits among low-income Medicare patients. The system is designed to control spending, but it often ignores human consequences. The rise of accumulator adjustment programs makes it worse. These programs don’t count manufacturer coupons toward your deductible. So even if you get a $100 coupon, your deductible doesn’t move. You still pay full price after the coupon runs out. In 2025, 71% of commercial plans and 43% of Medicare Part D plans will use them.

What’s Changing in 2025 and Beyond

The Inflation Reduction Act caps out-of-pocket drug costs at $2,000 a year for Medicare beneficiaries starting in 2025. That’s huge. It means insurers can’t just push expensive drugs to the highest tier and expect patients to pay $1,000 a month. They’ll need to design formularies differently-likely adding more mid-tier options and reducing specialty tier use. Also, value-based formularies are growing. Instead of just picking the cheapest drug, plans are starting to pay more for drugs that keep people out of the hospital. By 2027, nearly half of employer plans are expected to use them. AI tools are already predicting which patients are likely to stop taking a drug based on their history-with 89% accuracy. The future? Personalized formularies. Imagine your plan knowing your genetic profile, past responses to drugs, and lifestyle-and tailoring coverage accordingly. It’s not science fiction. 68% of industry leaders expect this within 10 years.What You Can Do Right Now

1. Check your formulary every October and after any life change. Use your insurer’s website or Medicare’s Plan Finder. 2. Ask your doctor if your drug is on formulary before they write the script. Say: “Is this covered under my plan?” 3. Save every notice about formulary changes-even if it seems minor. You’ll need it for appeals. 4. Know your appeal rights. For Medicare, you have 60 days to file an exception. For commercial plans, it’s usually 30 days. Don’t wait. 5. Use free help. SHIP counselors (for Medicare) or patient advocacy groups can walk you through the process. No cost. 6. Track your out-of-pocket costs. If you’re paying more than $500 extra a year because of a formulary change, you’re being overcharged. Fight it.Final Thought: You’re Not Just a Number

Insurance companies aren’t evil. They’re trying to manage billions in drug spending. But when your life depends on a pill, the system should bend-not break. The truth? Formularies aren’t going away. But you don’t have to accept them as final. With the right knowledge, you can navigate them. You can fight them. You can get your medication. And you deserve to.What should I do if my medication is removed from my insurance formulary?

First, check if there’s a covered alternative in the same drug class. If not, ask your doctor to submit a formulary exception request with clinical justification. You can also explore manufacturer assistance programs or contact your State Health Insurance Assistance Program (SHIP) for help. Don’t stop taking your medication-act within the appeal window, usually 30-60 days.

How much notice do insurers have to give before changing my drug coverage?

Medicare Part D plans must give 60 days’ notice for non-urgent changes. Commercial plans aren’t federally required to give any notice, but most provide 22-30 days on average. Always check your plan documents-some state laws require longer notice. Never assume you’ll get enough time.

Can I switch to a different insurance plan to avoid a formulary change?

Yes, but only during open enrollment periods. For Medicare, that’s October 15 to December 7. For employer plans, it’s usually once a year or after a qualifying life event like marriage, birth, or job loss. Outside those windows, you can’t switch unless you qualify for a special enrollment period.

Why do some drugs get moved to higher tiers even if they’re not expensive?

Insurers often move drugs to higher tiers to push patients toward generics or newer drugs that offer better rebates. A drug might be cheap, but if the manufacturer doesn’t pay a large rebate to the pharmacy benefit manager (PBM), it gets penalized. It’s not about cost-it’s about profit-sharing deals between insurers and drugmakers.

Are formulary changes more common with Medicare or private insurance?

Both see frequent changes, but Medicare Part D plans are more regulated. They must cover at least two drugs per therapeutic class and give 60 days’ notice. Commercial plans have fewer rules and change formularies more often-sometimes quarterly. In 2024, 78% of large pharmacy benefit managers reviewed formularies every three months.

What’s the difference between a formulary exception and a prior authorization?

A prior authorization is required before you can even get the drug-it’s a pre-approval step. A formulary exception is a request to cover a drug that’s not on the list at all. Both need doctor input, but exceptions are harder to get because they challenge the plan’s rules directly. Still, 64% of medically justified exceptions are approved.

Can I use GoodRx if my drug is off-formulary?

Yes. GoodRx coupons often offer lower prices than your insurance copay-even if the drug isn’t covered. Always compare the GoodRx price with your insurance price at the pharmacy. In 2023, 47% of patients saved money by using GoodRx when their drug was moved to a higher tier.

Do formulary changes affect generic drugs too?

Yes. Even generics can be removed or moved to higher tiers if a new generic enters the market and the insurer negotiates a better rebate. A 2024 study found that 12% of generic drug formulary changes led to increased patient costs. Always verify coverage-even for generics.

Adam Vella January 13, 2026

The structural inefficiencies inherent in contemporary pharmaceutical formularies reveal a deeper epistemological crisis in healthcare economics: the conflation of fiscal prudence with clinical efficacy. When insurers prioritize rebate structures over therapeutic outcomes, they inadvertently institutionalize patient harm as a cost-saving heuristic. The 64% exception approval rate is not a victory-it’s a testament to the systemic failure of pre-emptive formulary design. We are not managing drug access; we are rationing dignity through bureaucratic gatekeeping.

Moreover, the notion that ‘value-based formularies’ represent progress is a semantic sleight-of-hand. Value, in this context, is defined not by patient outcomes, but by the profitability of pharmaceutical partnerships. The AI-driven prediction models mentioned are not tools of personalization-they are instruments of predictive discrimination, targeting vulnerable populations for cost displacement.

And let us not forget the accumulator adjustment programs: legalized theft disguised as financial innovation. A $100 coupon that doesn’t count toward your deductible is not assistance-it’s a psychological trap, designed to make patients feel empowered while their financial burden remains unchanged. This is neoliberal healthcare in its most insidious form.

The Inflation Reduction Act’s $2,000 cap is a bandage on a hemorrhage. It does nothing to address the root cause: the monopoly power of PBMs and the absence of true price negotiation. Until we break the link between drug pricing and rebate manipulation, we are merely rearranging deck chairs on the Titanic of American healthcare.

Clay .Haeber January 15, 2026

Oh wow, another ‘you’re not powerless’ pep talk from someone who’s never had to pay $600 for insulin while their kid’s asthma inhaler got yanked. Congrats, you wrote a 2,000-word pamphlet on how to beg your insurance company for mercy. Meanwhile, real people are skipping doses because ‘checking your formulary in October’ doesn’t help when your refill is due tomorrow and your doctor’s office is closed.

And let’s be real-‘manufacturer assistance programs’? Most people don’t have time to fill out 17 forms, prove they’re poor enough, and wait 3 weeks for approval while their diabetes spirals. It’s not empowerment-it’s a circus. The only thing that ‘saves’ people is luck, a rich relative, or a miracle.

Also, ‘value-based formularies’? Sounds like corporate speak for ‘we’re gonna pick the drug that gives us the biggest kickback, then call it science.’

Angel Tiestos lopez January 15, 2026

bro this hit different 😔💊

imagine your life depending on a pill that some suit in a cubicle decides is ‘not cost-effective’ 🤡

we’re not talking about luxury meds here-we’re talking about people who can’t breathe, can’t walk, can’t function… and the system treats them like a spreadsheet error.

also goodrx is kinda the only thing keeping me alive rn 🙏

and why do they even call it ‘formulary’? sounds like a wizard’s spellbook. ‘by the power of rebate, thou shalt not be covered!’ 🧙♂️💸

Alan Lin January 16, 2026

It is imperative to acknowledge that the current framework of pharmaceutical formulary management constitutes a fundamental breach of the ethical obligation inherent in the physician-patient relationship. The absence of mandatory real-time formulary integration into electronic prescribing systems is not merely an administrative oversight-it is a dereliction of professional duty by healthcare institutions and insurers alike.

Patients are being systematically disenfranchised through opaque decision-making processes, often without adequate notice or recourse. The statistic that 57% of patients receive little to no warning regarding formulary changes is not just alarming-it is indefensible. The onus must shift from the patient to the provider and the payer: formulary compliance must be verified prior to prescription issuance, not after the patient has already paid out-of-pocket.

Furthermore, the proliferation of accumulator adjustment programs represents a moral failure of unprecedented scale. These mechanisms actively undermine the intent of manufacturer assistance, transforming charitable support into a mechanism of financial exploitation. This is not healthcare. This is predatory economics.

Healthcare providers must adopt a zero-tolerance stance toward formulary opacity. Clinicians who fail to verify coverage prior to prescribing are complicit in patient harm. We must demand institutional accountability, legislative reform, and systemic transparency. The time for passive compliance is over.

Trevor Whipple January 18, 2026

lol i had this happen with my biologic and thought i was gonna die 😭

turned out my doc just didn't check the formulary and i had to call my insurance 12 times before they gave me a 30-day bridge

also goodrx saved me like 400 bucks that month

and yeah the coupons dont count toward your deductible?? that's bs. why even give them??

also why do they even have 5 tiers?? its just so they can make you feel like you're getting a deal when you're not

John Pope January 18, 2026

Let’s be clear: this isn’t a ‘formulary change.’ It’s a corporate assassination. You’re not losing a drug-you’re losing your autonomy, your dignity, your sleep, your job, your marriage. The PBM executives don’t care if you’re on Humira or metformin-they care about the rebate percentage and the quarterly earnings call.

And the ‘appeal process’? That’s not a right-it’s a performance art. You need a doctor who cares enough to write a novel-length letter, a case manager who isn’t on vacation, and a goddamn miracle. Meanwhile, your body is deteriorating while you wait for a response from someone who’s paid to say no.

And don’t get me started on ‘value-based formularies.’ That’s just code for ‘we’re going to pick the drug that makes us the most money, then slap a ‘clinical outcome’ sticker on it.’

The Inflation Reduction Act? Cute. It caps your out-of-pocket at $2,000-but what if your drug costs $12,000 a year? You still pay $2,000. The rest? Absorbed by your premiums. That’s not relief. That’s a tax on the sick.

We’re not talking about policy. We’re talking about survival. And the system is rigged.

Priyanka Kumari January 20, 2026

Thank you for this comprehensive and deeply needed overview. As someone who works with patients navigating chronic illness across cultures, I can confirm that the emotional toll of formulary changes is often underestimated. Many patients feel shame when they cannot afford their medication, believing it is their personal failure rather than a systemic flaw.

I encourage everyone to reach out to SHIP counselors-they are trained, free, and genuinely want to help. In India, we have similar advocacy networks for affordable medicines, and I believe the model can be adapted here. Community support is not a luxury-it is a lifeline.

Also, please remember: your voice matters. When patients speak up, insurers listen. Write letters. Call your representatives. Share your story. Change begins with one person refusing to stay silent.

Avneet Singh January 22, 2026

Wow. So much… *content*. But let’s cut through the noise: this is just another op-ed disguised as public service. The real issue? The entire U.S. pharmaceutical supply chain is a cartel disguised as a market. PBMs, manufacturers, insurers-all colluding to extract rent. The formulary is just the theater.

‘Check your formulary in October?’ That’s like telling someone to check their house for earthquakes before buying it. The system is fundamentally broken. No amount of ‘tips’ fixes a structural collapse.

Also, ‘value-based formularies’? Please. The only value here is shareholder value. Everything else is marketing fluff.

Nelly Oruko January 22, 2026

Formularies are just insurance’s way of saying ‘we’re sorry you’re sick.’

vishnu priyanka January 24, 2026

yo from india we got this thing called ‘Jan Aushadhi’ where generic meds cost like $1 a month… and we still have people dying from lack of access. so yeah, this ain’t just an american problem. it’s a capitalism problem. 🤷♂️💊

Lethabo Phalafala January 25, 2026

I cried when my insulin got pulled. Not because I was scared of the cost-I was scared of what my body would do if I didn’t get it. I spent 11 days calling, emailing, begging. I had to borrow money from my sister. I didn’t tell my kids. I didn’t tell my boss. I just showed up to work and pretended I was fine.

Then one day, my pharmacist said, ‘Here’s a coupon. It’s not covered, but it’s cheaper than your insurance copay.’ That’s not help. That’s a punch in the gut with a velvet glove.

And now? Now I’m scared every time my refill comes due. Because next month? It could happen again.

They say ‘you’re not powerless.’ But they never tell you how exhausting it is to fight for your own life every single day.

Lance Nickie January 26, 2026

nah bro they just move the drug to tier 4 and call it ‘value-based.’ same thing. 🤡

Milla Masliy January 27, 2026

My mom’s on Medicare and they switched her blood pressure med last year-she had a mini-stroke because she couldn’t afford the new one. We appealed. Got approved. But it took 47 days. She was scared to even go to the bathroom alone.

It’s not about ‘tips.’ It’s about people being treated like numbers. I’m so tired.

Damario Brown January 28, 2026

Let’s be honest-this whole article is just a PSA for PBM shareholders. ‘Use GoodRx!’ ‘Apply for assistance!’ ‘Check your formulary!’

Meanwhile, the real problem-drug monopolies, rebate kickbacks, zero price negotiation-isn’t even mentioned in the same sentence as ‘insurance.’

You’re not solving the problem. You’re just teaching people how to survive it.

And that’s the real tragedy.