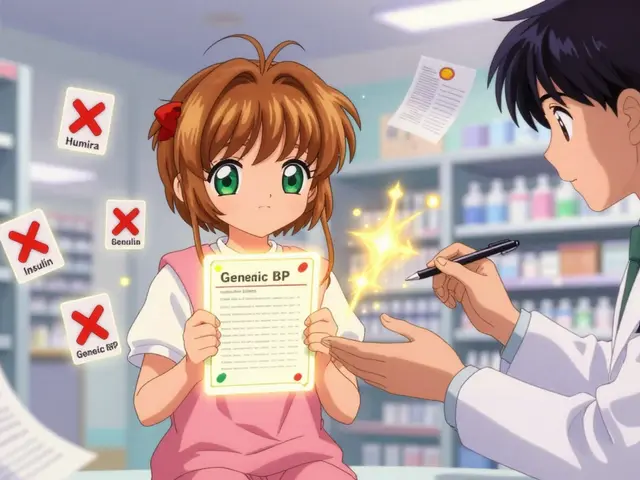

Formulary Coverage Checker

Check Your Medication Coverage

Ensure your prescription medications are still covered by your insurance plan. Avoid unexpected cost increases or coverage denials.

Enter your medication and insurance plan to check coverage.

Remember: Formularies change frequently. Check your coverage annually during enrollment periods (October 15-December 7 for Medicare, or your plan renewal date for commercial insurance).

When your insurance plan changes the list of drugs it covers, it’s not just a paperwork update-it can mean your monthly bill jumps from $45 to $450 overnight. That’s what happened to a Medicare beneficiary in Florida in 2023 when his heart medication was moved from Tier 2 to Tier 4. He didn’t get a heads-up. He didn’t get a replacement. He just got a bill he couldn’t afford. This isn’t rare. In 2022, 12.7% of Medicare beneficiaries had at least one medication removed from their plan’s formulary. For many, it meant skipping doses, delaying refills, or even ending up in the ER.

What Exactly Is a Formulary?

A formulary is the official list of prescription drugs your insurance plan agrees to pay for. It’s not a suggestion. It’s a rulebook. Every health plan-Medicare Part D, employer insurance, Medicaid-uses one. These lists are built by teams of doctors and pharmacists who decide which drugs work best, are safest, and cost the least. The goal? Keep your care effective without breaking the bank. But here’s the catch: formularies change. Every year. Sometimes mid-year. And if you’re not watching, you could wake up one day to find your medication is no longer covered-or it’s now in the most expensive tier. In 2023, 23% of insurance plans made changes outside of their annual update. That’s more than 1 in 5 plans shifting coverage without warning.How Formulary Tiers Work (And Why They Matter)

Most formularies use a tier system. Think of it like a pricing ladder:- Tier 1: Generic drugs. Usually $0-$10 copay. These are the same medicine as brand names but cheaper because the patent expired.

- Tier 2: Preferred brand-name drugs. $25-$50. These are the ones your plan wants you to use because they’re proven and cost-effective.

- Tier 3: Non-preferred brand-name drugs. $50-$100. Your plan still covers these, but they cost more because there are cheaper alternatives.

- Tier 4/5: Specialty drugs. $100+ or a percentage of the price. These are for complex conditions like cancer, MS, or rheumatoid arthritis. Some cost over $1,000 a month.

Why Formularies Change (And Who Decides)

Formularies aren’t static. They’re updated based on:- New generic versions hitting the market

- Drug safety alerts from the FDA

- Price negotiations between insurers and drugmakers

- Cost-effectiveness studies showing better alternatives

How to Check Your Formulary Before It’s Too Late

You can’t rely on your insurer to notify you in time. In a 2023 Consumer Reports survey, 68% of Medicare beneficiaries said it was hard to find their plan’s formulary online. Here’s how to do it right:- Find your plan name. Look at your insurance card. Don’t guess. Write it down.

- Go to your insurer’s website. Search for “formulary,” “drug list,” or “prescription coverage.” It’s often under “Plan Materials” or “Member Resources.”

- Search for your medications. Type in the exact name-brand and generic. Don’t rely on the therapeutic class.

- Check the tier and restrictions. Is it on the list? What’s the copay? Do you need prior authorization or step therapy?

- Do this every year during Open Enrollment. For Medicare, that’s October 15 to December 7. For commercial plans, check when your plan renews-usually January 1.

What to Do If Your Drug Gets Removed

If your medication is taken off the formulary, you have options. Don’t panic. Don’t stop taking it. Do this:- Ask your doctor for a therapeutic alternative. Is there another drug in the same class that’s still covered? For example, if your brand-name statin was removed, there are 5+ generic alternatives that work just as well.

- Request a formulary exception. Your doctor can submit a request saying why you need the drug. Common approved reasons: you tried cheaper options and had side effects, or you’ve been stable on this drug for years. 78% of exceptions are approved within 72 hours if submitted correctly.

- Appeal if denied. You have the right to appeal. Most plans have a 3-step process: initial request, reconsideration, external review. Keep copies of every email, letter, and phone call.

- Check for patient assistance programs. Many drugmakers offer free or low-cost meds if you qualify based on income. Websites like NeedyMeds.org list them.

The Hidden Risks of Formulary Changes

The biggest danger isn’t the cost-it’s the delay. A 2023 study found that each additional formulary restriction reduces medication adherence by 5.2 percentage points. That means more people skip doses. More people end up in the hospital. More people die. The National Patient Advocate Foundation found that 43% of patients experienced treatment delays due to formulary changes. 18% reported serious health outcomes-like uncontrolled blood pressure, worsening diabetes, or a cancer recurrence. And it’s worse for older adults and people with multiple chronic conditions. Medicare beneficiaries with 3+ chronic diseases are 3 times more likely to be affected by formulary changes than younger, healthier people.

What’s Changing in 2025?

The Inflation Reduction Act is reshaping formularies. Starting January 1, 2025:- Medicare Part D patients will pay no more than $2,000 out-of-pocket for drugs annually.

- Insulin will remain capped at $35 per month.

- Medicare will begin negotiating prices for 10 high-cost drugs in 2026, with more added each year.

Pro Tips to Stay Protected

- Keep a printed copy of your current formulary. Save it on your phone. Don’t rely on memory.

- Ask your pharmacist at refill time: “Is this still covered?” They see formulary updates daily.

- If you’re switching plans, compare formularies before you enroll. Don’t assume your meds will be covered.

- Use tools like Medicare’s Plan Finder or GoodRx to compare costs across plans.

- Join a patient advocacy group. They track formulary changes and help with appeals.

Final Thought: You’re Not Powerless

Formularies are designed to save money. But they shouldn’t cost you your health. The system favors insurers and PBMs-not patients. But you have rights. You have tools. And you have the power to speak up. Don’t wait until your prescription is denied. Check your formulary now. Talk to your doctor. Know your options. Your next refill could depend on it.What happens if my medication is removed from the formulary?

If your medication is removed, you can request a formulary exception through your doctor. They’ll need to explain why you need it-usually because you tried cheaper alternatives and had side effects or they didn’t work. Most requests (78%) are approved within 72 hours. You can also ask for a therapeutic alternative or apply for patient assistance programs.

How often do insurance formularies change?

Most formularies update once a year, usually on January 1. But about 23% of plans make changes mid-year. These changes can include removing a drug, moving it to a higher tier, or adding prior authorization. You’re not always notified in advance, so checking your formulary annually is critical.

Are generic drugs always better than brand names?

For most medications, yes. Generics contain the same active ingredient as brand names and are required by the FDA to work the same way. They’re cheaper because they don’t include marketing or R&D costs. But for a small number of drugs-like certain seizure meds or thyroid hormones-some patients respond better to one brand. If that’s you, your doctor can request an exception.

Can I switch insurance plans to avoid formulary changes?

Yes, but only during specific enrollment periods. For Medicare, that’s October 15 to December 7. For employer plans, it’s usually during open enrollment or after a life event like moving or losing a job. Always check the formulary of any new plan before switching. Don’t assume your meds will be covered just because you liked your old plan.

Why is it so hard to find my formulary online?

Insurers often bury formulary documents in hard-to-find sections of their websites. Many don’t make them searchable or mobile-friendly. In 2023, 68% of Medicare beneficiaries struggled to find theirs. Always search for “drug list,” “formulary,” or “prescription coverage” on your plan’s site. If you can’t find it, call customer service and ask for the current formulary PDF.

James Hilton December 28, 2025

So let me get this straight-we’re trusting corporations who make billions off our prescriptions to *not* screw us over? Lol. 🤡

Celia McTighe December 30, 2025

This hit me right in the feels. My mom had to switch meds last year and nearly lost her mind trying to navigate the paperwork. Seriously, nobody warns you how brutal this system is. 💔

Mimi Bos December 31, 2025

i just checked my formulary and my blood pressure med is now tier 4?? i thought i was good?? 😭

Debra Cagwin January 2, 2026

If you're reading this and you're worried about your meds-don't wait. Print your formulary. Save it. Text it to someone you trust. You're not being paranoid, you're being smart. 💪

Teresa Marzo Lostalé January 2, 2026

You know what’s wild? In my country, we don’t have formularies like this. If a doctor prescribes it, you get it. No tiered nonsense. No $1,000 pills that require 7 forms to approve. We just... treat people. It makes me sad we’ve turned healthcare into a spreadsheet.

Sydney Lee January 3, 2026

The fact that PBMs are literally incentivized to push higher-cost drugs while pretending to be cost-savers is a textbook case of regulatory capture. This isn’t negligence-it’s a coordinated, profit-driven betrayal of the vulnerable. The FTC lawsuit is a start, but we need criminal charges.

Ellen-Cathryn Nash January 4, 2026

I’ve seen people cry in pharmacy lines because their insulin got moved to Tier 5. I’ve seen grandparents choose between food and their heart meds. This isn’t a policy issue-it’s a moral failure dressed up in corporate jargon.

Ryan Touhill January 5, 2026

I’ve worked in healthcare administration for 18 years. Let me tell you-formularies aren’t designed by doctors. They’re designed by actuaries who’ve never met a patient. The ‘clinical review’? A rubber stamp. The real decision-makers? The ones who get paid by the drugmaker’s kickback.

Kelsey Youmans January 6, 2026

The data presented in this article is both statistically significant and ethically alarming. It is imperative that stakeholders-patients, providers, and policymakers-engage in a structured dialogue to reform the current formulary governance model. Transparency, accountability, and patient-centered care must be non-negotiable pillars of future policy.

oluwarotimi w alaka January 7, 2026

this is why america is doomed. they let big pharma and wall street run everything. even in nigeria we dont let companies decide who lives or dies. here, you need a lawyer to get your own medicine. lol

Hakim Bachiri January 7, 2026

I swear to god, if I see one more ‘step therapy’ form, I’m gonna scream. They want me to try 3 generics that don’t work, then die slowly, then maybe-*maybe*-they’ll approve the drug that keeps me alive? This isn’t medicine. It’s a horror movie written by a bureaucrat with a calculator.

Nicole Beasley January 8, 2026

I just looked up my meds on GoodRx and found the same drug for $12 cash at Walmart. Why do I even have insurance? 😅

sonam gupta January 9, 2026

in india we dont have tier system we just pay cash and get medicine if you rich you get brand if you poor you get generic but at least you get it no forms no waiting no corporate drama

Samantha Hobbs January 10, 2026

I just called my insurance and they said they ‘sent me an email’ about the change. I never got it. They have my email. I checked spam. I checked trash. I checked my phone. I checked my cat’s collar. Where is it??

Julius Hader January 11, 2026

I’m just saying-if you’re on a chronic med, you should have a lawyer on speed dial. And a spreadsheet. And a backup prescription. And a friend who works at the pharmacy. And a prayer. That’s the new American healthcare routine.