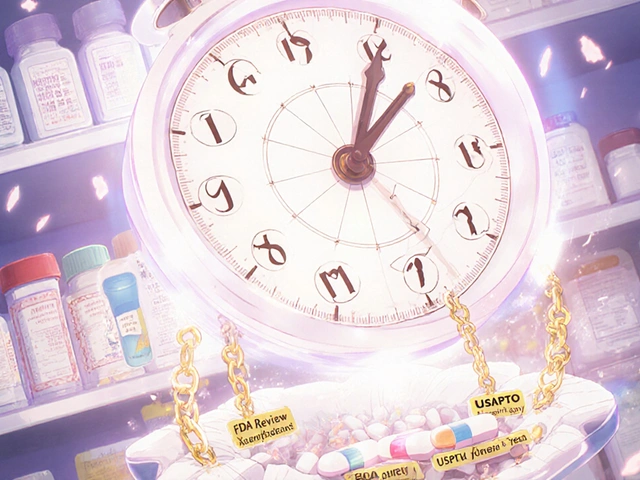

When a brand-name drug hits the market, its patent gives the company a monopoly-often for 20 years. But that clock doesn’t start ticking until the drug is approved by the FDA. Meanwhile, generic manufacturers are already planning their move. They don’t wait for the patent to expire. Instead, they file what’s called a Paragraph IV certification-a legal bomb dropped right into the middle of the patent system. This isn’t piracy. It’s a carefully engineered loophole in U.S. drug law that lets generics challenge patents before they even make a single pill.

How the Hatch-Waxman Act Created a Legal Trap for Big Pharma

The system wasn’t designed to be this dramatic. In 1984, Congress passed the Drug Price Competition and Patent Term Restoration Act-better known as the Hatch-Waxman Act. Its goal was simple: get cheaper generic drugs to patients faster, while still protecting innovation. The solution? A legal fiction. Under Section 271(e)(2) of U.S. patent law, submitting an application to make a generic version of a drug while a patent is still active counts as an “artificial act of infringement.” That means the brand-name company doesn’t have to wait until the generic hits shelves to sue. They can sue the moment the paperwork is filed. This flipped the script. In most industries, if you think someone’s copying your invention, you wait until they start selling it. Then you sue. In pharma, the generic company has to prove they’re not infringing before they even begin production. It’s like being told you can’t open a restaurant until you prove the neighbor’s recipe isn’t copyrighted. The system forces conflict early-and it’s exactly what Congress intended.What a Paragraph IV Certification Actually Says

Every generic drug application (called an ANDA) must include a certification about every patent listed for that drug in the FDA’s Orange Book. There are four types. Paragraph I says the patent has expired. Paragraph II says it will expire soon. Paragraph III says the generic will wait until the patent expires. But Paragraph IV? That’s the one that changes everything. A Paragraph IV certification is a formal legal statement that says: “One or more of these patents are invalid, unenforceable, or won’t be infringed by our product.” That’s it. No proof yet. No product made. Just a declaration. But it triggers a chain reaction. The generic company has 20 days to notify the patent holder. The brand company then has 45 days to file a lawsuit. If they do, the FDA automatically blocks approval of the generic for 30 months-or until a court rules otherwise. This isn’t a delay tactic. It’s a strategic pause. The brand company gets to defend its patent without risking market damage. The generic gets to test the patent’s strength before spending millions on manufacturing. And if the generic wins? They get 180 days of exclusive market access. No competition. That’s often worth hundreds of millions in profit.The 180-Day Prize That Drives Billion-Dollar Battles

The real engine behind Paragraph IV filings isn’t just lower prices-it’s exclusivity. The first generic company to file a successful Paragraph IV certification gets 180 days of market exclusivity. During that time, no other generic can enter. That’s why companies like Teva, Mylan, and Sandoz spend millions on legal teams just to be first. In 2023 alone, those 180-day exclusivity periods generated $4.7 billion in extra revenue for the first filers. For a blockbuster drug like Humira, which brought in over $20 billion a year at its peak, 180 days of monopoly sales means nearly $10 billion in revenue. That’s why generics don’t just challenge patents-they challenge multiple patents on the same drug. In 2024, 68% of major brand-name drugs faced three or more Paragraph IV filings. But here’s the catch: winning isn’t easy. Legal fees average $12.3 million per case. Cases take nearly 29 months to resolve. And even if you win, the brand company might settle. In 78% of cases, the two sides reach an agreement. Many of those deals include “pay-for-delay” terms-where the brand pays the generic to delay launch. The FTC sued 17 such deals in 2023 and 2024. These settlements can push back generic entry by over two years, costing consumers billions.

Carve-Outs and Skinny Labels: The Silent Strategy

Not every Paragraph IV challenge is about taking the whole drug. Sometimes, generics take only part of it. This is called a Section viii carve-out. It happens when a drug is approved for multiple uses, but only one use is still under patent. For example, a drug might be approved for treating both Type 2 diabetes and heart failure. If the patent only covers the heart failure use, the generic can still launch-but only for Type 2 diabetes. They remove the heart failure indication from their label. That’s called a “skinny label.” This tactic is used in about 37% of Paragraph IV filings. It’s smart. It avoids patent litigation entirely. The generic doesn’t have to prove the patent is invalid. They just don’t market the protected use. The FDA allows it. Doctors can still prescribe it off-label. And patients get cheaper access to the parts of the drug that aren’t patented.Why Big Pharma Keeps Filing More Patents

You’d think once a drug is approved, the patent landscape is set. But it’s not. Brand companies have learned to game the system. In 2005, the average drug had 7.2 patents listed in the Orange Book. By 2024, that number jumped to 17.3. That’s not because the science got more complex. It’s because companies are stacking patents-on minor changes in dosage, crystal form, delivery method, or even packaging. This is called “evergreening.” Each patent adds another layer of protection. Each one must be challenged separately. The more patents, the more legal hurdles for generics. And since each patent triggers its own 30-month stay, companies can stretch out exclusivity for years. A 2025 analysis found that 31% of Paragraph IV targets were affected by “product-hopping”-where a brand releases a slightly reformulated version just before generic entry. The new version gets a new patent. The old one expires. The generic has to start over.

Who’s Winning-and Who’s Losing

The data shows a clear shift. From 2003 to 2019, generics won only 41% of Paragraph IV cases. But from 2020 to 2025, that number jumped to 58%. Why? Two reasons: Supreme Court rulings have made it harder to patent obvious modifications, and generic companies are getting better at analyzing patents before filing. Teva led the pack in 2024 with 147 Paragraph IV filings. Mylan, Sandoz, and Hikma followed. The most targeted drugs? AbbVie’s Humira (28 challenges), Eli Lilly’s Trulicity (24), and Pfizer’s Eliquis (21). These aren’t random. They’re billion-dollar drugs with high margins and long patent lives. Consumers are winning too. Since 1984, Paragraph IV challenges have saved U.S. patients $2.2 trillion. In 2024 alone, they saved $192 billion. That’s money that went back into people’s pockets instead of pharmaceutical balance sheets.The Future: Tighter Rules and More Challenges

The FDA’s 2022 rule update closed a loophole that let generics change their Paragraph IV certifications after lawsuits started. Now, if a court rules a patent is valid, the generic can’t just tweak their application and try again. They have to file a new ANDA. That’s a win for transparency. In 2026, the FDA plans to require brand companies to justify every patent they list in the Orange Book. If they can’t show a real connection between the patent and the drug’s use, it gets removed. Analysts predict this could cut patent thickets by 30-40%. The FTC is also stepping up. They’re targeting pay-for-delay deals harder than ever. If they succeed, generics could enter the market 4-6 months earlier on average. The bottom line? Paragraph IV certifications aren’t going away. They’re getting smarter, more common, and more powerful. As long as there’s money to be made in generic drugs, companies will keep challenging patents. And as long as patents are used to block competition, the system will keep pushing back.What is a Paragraph IV certification?

A Paragraph IV certification is a legal statement made by a generic drug manufacturer when filing an Abbreviated New Drug Application (ANDA). It declares that one or more patents listed for the brand-name drug in the FDA’s Orange Book are invalid, unenforceable, or will not be infringed by the generic product. This triggers a patent lawsuit from the brand company and can lead to early market entry for the generic.

How does Paragraph IV help lower drug prices?

Paragraph IV certifications allow generic manufacturers to challenge patents before the brand-name drug’s exclusivity ends. If successful, the first generic to file gets 180 days of market exclusivity, which forces competition and drives down prices. Since 1984, these challenges have saved U.S. consumers over $2.2 trillion.

Why do brand companies list so many patents?

Brand companies list multiple patents-sometimes over 17 per drug-to create a “patent thicket.” Each patent can trigger a 30-month stay on generic approval. Even if one patent is weak, others can delay competition. This tactic, called evergreening, extends market exclusivity beyond the original patent term.

What is the 180-day exclusivity period?

The first generic company to successfully file a Paragraph IV certification gets 180 days of exclusive rights to sell their version of the drug. No other generic can enter during that time. This incentive encourages companies to take legal risks, as the potential profits from being first can exceed $1 billion for blockbuster drugs.

Can a generic drug enter the market without challenging a patent?

Yes. Generics can file a Paragraph III certification, which says they’ll wait until all patents expire. But that delays entry by years. Paragraph IV is the only way to challenge patents early. Some generics also use Section viii carve-outs-launching only for non-patented uses-avoiding litigation entirely.

What’s the difference between Paragraph IV and a “pay-for-delay” deal?

A Paragraph IV certification is a legal challenge filed by a generic company. A “pay-for-delay” deal is a settlement where the brand company pays the generic to delay launching. These deals are controversial because they block competition and raise prices. The FTC has sued dozens of them as anti-competitive.

Dylan Smith December 16, 2025

This whole system is wild. Generic companies basically sue before they even make the drug. I didn't realize the law was this backwards. It's like being accused of theft before you've taken anything.

And that 180-day monopoly for the first filer? That's not competition, that's a lottery win with a billion-dollar prize.

Ron Williams December 18, 2025

I've been on the receiving end of this as a pharmacist. When a big drug goes generic, prices drop like a rock. One pill that cost $120? Now it's $4. Patients cry happy tears. The system works, even if it's messy.

Aditya Kumar December 19, 2025

Too much text. I just want to know if generics are cheaper. Answer: yes. Done.

Tiffany Machelski December 21, 2025

I never knew about skinny labels. That's actually genius. Why fight a patent when you can just not mention the part that's patented? Makes so much sense

SHAMSHEER SHAIKH December 22, 2025

The Hatch-Waxman Act represents a masterstroke of legislative engineering, wherein the delicate balance between intellectual property rights and public health imperatives was harmonized through a precisely calibrated legal mechanism. The Paragraph IV certification, in particular, serves as a pivotal instrument in the democratization of pharmaceutical access, enabling market competition to flourish within the boundaries of constitutional jurisprudence.

Souhardya Paul December 23, 2025

The 180-day exclusivity is the real kicker. It's not about saving money-it's about who gets to be the first to cash in. That's why companies like Teva are basically legal sharks. They don't care if the patent is weak, they just want to be first to file. It's a race to the courthouse, not the pharmacy.

Josias Ariel Mahlangu December 25, 2025

This is why America is broken. You let companies game the system like this? The patent system was meant to protect innovation, not let corporations stretch it out for decades with nonsense patents on packaging. It's corporate greed dressed up as law.

anthony epps December 25, 2025

So generics can challenge patents before making the drug? That sounds kinda unfair. But then again, the brand drugs charge so much, maybe it's needed. I don't get all the legal stuff but I know my insulin is cheaper now.

Andrew Sychev December 27, 2025

THIS IS WHY WE CAN'T HAVE NICE THINGS. BIG PHARMA ISN'T THE VILLAIN HERE-THEY'RE JUST PLAYING THE GAME. THE REAL VILLAIN IS THE GOVERNMENT THAT LETS THIS SYSTEM EXIST. 180 DAYS OF MONOPOLY? THAT'S NOT FREE MARKET, THAT'S STATE-SANCTIONED LOOTING.

AND PAY-FOR-DELAY? THAT'S BRIBERY. THEY SHOULD BE IN PRISON. NOT JUST FINED.

Dan Padgett December 27, 2025

You know, in my village back home, if someone built a better version of your pot, you'd share the recipe. Here, they sue each other over the shape of the handle. We've turned medicine into a battlefield where the only winners are lawyers and the very rich. It's not progress-it's poetry written in dollars and injunctions.

Hadi Santoso December 29, 2025

Skinny labels are genius. I didn't even know that was a thing. So you just remove the part that's patented and sell the rest? That's like selling a burger without the cheese because the cheese recipe is copyrighted. Brilliant. The FDA gets it.

Kayleigh Campbell December 30, 2025

So let me get this straight. You can't make a generic drug until you prove the patent is garbage… but you don’t even have to make the drug to prove it? That’s like being told you can’t open a bakery until you prove the neighbor’s sourdough starter isn’t patented. And then you win and get to be the only bakery for 6 months? This isn’t capitalism. This is a reality show called 'Pharma: The Legal Game'.

Joanna Ebizie December 30, 2025

Big Pharma is literally just patenting the color of the pill now. That’s not innovation, that’s a scam. And the FDA lets them? I’m not mad, I’m just disappointed.

Elizabeth Bauman December 31, 2025

This is why we need to ban foreign generics. Why are Indian companies like Teva and Hikma getting rich off American patents? This isn't innovation-it's theft. We built the system, and now they're using it to steal our medicine. America first, not Teva first.

Mike Smith December 31, 2025

The data speaks clearly: since 1984, Paragraph IV challenges have generated over $2.2 trillion in savings for American consumers. This is not merely a legal maneuver; it is a public health triumph. The persistence of generic manufacturers in navigating complex patent landscapes ensures that life-saving medications remain accessible to those who need them most. We must safeguard this mechanism and enhance its transparency, not dismantle it.