PBM Negotiations: How Pharmacy Benefit Managers Control Your Drug Costs

When you pick up a prescription, the price you see isn’t set by your doctor or pharmacy—it’s shaped by PBM negotiations, contracts between pharmacy benefit managers, drug makers, and insurers that determine which drugs are covered and at what price. Also known as pharmacy benefit managers, these companies act as middlemen between drug manufacturers, insurers, and pharmacies, and their deals directly affect what you pay out of pocket. Most people don’t realize PBMs don’t just negotiate discounts—they also create formularies that block cheaper generics, push brand-name drugs, and take a cut from every prescription filled.

PBM negotiations are behind why some drugs cost $500 one month and $20 the next. They’re why your insurer says a drug isn’t covered, even if your doctor swears it’s the best option. These deals often favor high-cost drugs that give PBMs bigger rebates, not the ones that work best for you. For example, a drug with a $100 rebate might get top placement on a formulary, even if a $20 generic does the same job. This isn’t about health—it’s about profit. And when PBMs control over 80% of prescriptions in the U.S., their decisions ripple through every part of the system, from Medicare Part D to your local pharmacy shelf.

That’s why understanding PBM negotiations matters. If you’re on long-term meds, dealing with high copays, or stuck with a drug your doctor doesn’t recommend, it’s likely because of a contract signed behind closed doors. You’ll find posts here that break down how these deals hide in plain sight—like how PBM negotiations affect access to drugs like atorvastatin or doxycycline, why some medications disappear from formularies overnight, and how Medicare Part D plans are shaped by these same agreements. You’ll also see how drug pricing tricks, like rebate cliffs and tiered formularies, impact real people trying to manage chronic conditions or afford life-saving treatments.

There’s no magic fix, but knowing how PBMs work is the first step to pushing back. Whether you’re trying to get a drug covered, switching insurers, or just wondering why your prescription cost jumped, the answers are buried in these negotiations. Below, you’ll find real examples from patients, doctors, and researchers who’ve seen how these systems play out—and what you can do about it.

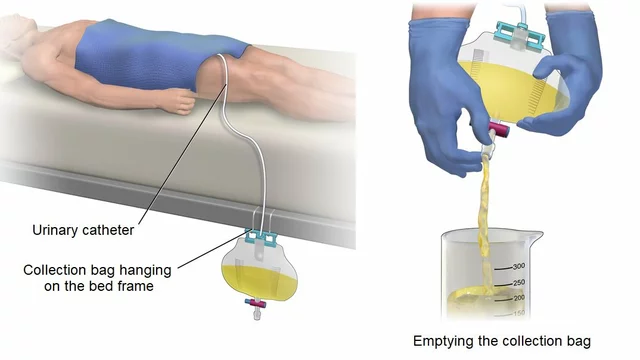

How Insurer-Pharmacy Negotiations Set Generic Drug Prices in the U.S.

Generic drugs are supposed to be cheap, but insurance often makes them more expensive than paying cash. Here’s how insurer-pharmacy negotiations set prices-and how you can beat the system.